Focus on Core Business Growth, CannaBZ will take care of complexity of Accounting, Payroll & Taxes.

The evolving cannabis enterprise offers awesome possibilities for growth; however, cannabis organizations also face complicated and hard issues ranging from Accounting, Tax, and Compliance with changing state and federal rules to adherence with phase 280E of the IRS tax code.

In this enormously regulated industry, we know that complicated accounting and tax legal guidelines could make walking your business tough. You shouldn’t need to face these challenges yourself.

At CannaBZ . We apprehend the daily monetary limitations hashish organizations are faced with, and we’re here to help! Our cannabis accountants will graph and put together federal, state, and neighbourhood earnings tax returns on your business, with the maximum contemporary cannabis taxation laws in idea.

We help you well allocate fees in order that your business can optimize deductions and lessen taxes owed.

Cannabis Market Insights

Cannabis is used in a variety of ways – in oils, tinctures, dried flowers, or buds. A lot of the time, it is used to stop or lessen epileptic convulsions. It is a sought-after treatment for persistent pain management in illnesses like multiple sclerosis and HIV/AIDS because the active ingredients, CBD and THC, act on the pain receptors and inhibit signal transmission.

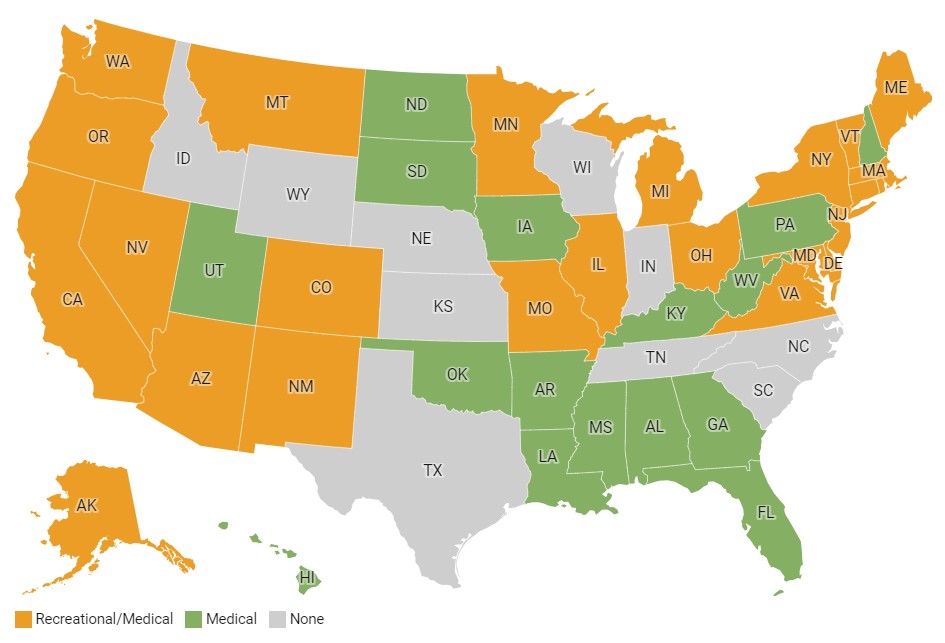

The legal cannabis industry has been significantly shaped by North America, especially the United States and Canada. Significant numbers of states in both countries have legalized cannabis for recreational use in addition to sanctioning its use for medical purposes. This increase in acceptance can be ascribed to cannabis' superior effectiveness in treating chronic illnesses compared to conventional therapies, which has led to a noticeable increase in the local market.

North American Legal Cannabis Market size was valued at USD 13.48 billion in 2021 and is poised to grow from USD 15.5 billion in 2022 to USD 47.41 billion by 2030, growing at a CAGR of 15% in the forecast period (2023-2030).

Cannabidiols, or the active substances in cannabis, have received a scant amount of thorough research on their effects and processes, but its acceptance as an alternative treatment option is growing.

Growth in the cannabis industry is anticipated as a result of governmental efforts to control the illegal drug trade. The MORE (Marijuana Opportunity, Reinvestment, and Expungement) Act's reappearance in the U.S. House of Representatives serves as an excellent example.

If this proposal is approved, it might end the federal ban of cannabis and promote decriminalization. From an economic standpoint, adult use legalization promises to increase employment and significantly boost the economy across a number of industries, including travel, real estate, banking, food, and transportation. This upcoming change in law is expected to increase the number of people who use cannabis legally and decrease the existence of the black market, supporting the expansion of the legal business in North America.

Map Space

Daily managerial tasks might blind you to the wider picture in a risky market like cannabis. We free you up to concentrate on the task of creating and honing your vision for strategic growth by placing your business on firm financial ground

Why Choose CannaBZ Accounting

In last 8 Years, we witnessed a phenomenal growth of companies associate with cannabis industry & won a trust being most trustworthy partner for Accounting, Bookkeeping, Payroll and Tax Services.

Our team of highly skilled professionals combines expert knowledge of the cannabis industry with extensive experience in tax and accounting, ensuring that our clients receive the highest level of service and support so they can focus on their core business growth while rest all complexities of Accounting, Tax Compliances being taken care by CannBZ.

Our steadfast dedication to helping clients in every segment of the cannabis industry – from seed to sale – manage highly complex tax and accounting issues has made CannaBZ , the premier independent accounting and advisory firm for cannabis businesses.

However, we are more than just an accounting firm. We are your advisors, partners, and navigators on your business journey. Our expertise extends beyond accounting, delving deeply into a comprehensive understanding of various business models and the intricate regulatory landscapes that come along with them. We use this knowledge to help you grow your business, offering strategic and personalized solutions.

Here at CannaBZ, we’re not just a team of accounting professionals. We are your trusted advisors, enabling you to navigate all areas of the cannabis industry, from seed to sale. Our unique expertise allows you to manage and navigate the intricate tax and accounting challenges that are synonymous with the cannabis sector

CannaBZ is a leading accounting firm specializing in providing comprehensive financial services to all types of businesses, including cannabis dispensaries, growers, manufacturers, producers, transportation services, and more.

Whether you’re a new startup business that needs a little guidance getting up and running, or a larger established cannabis grower, dispensary, or retailer, our knowledgeable and experienced team of cannabis accountants can help design accounting services and programs that fit your specific business needs.

CannaBZ having extensive exposure to handle complex accounting and tax issues and routine a so as one of the most reliable among the cannabis accounting firms.

We’re committed to providing you with the powerful, accurate, and confidential accounting solutions you need so that your cannabis business can remain compliant and continue growing for many years to come.

Cannabis Accounting Services You Can Trust

CannaBZ Tax and Accounting professionals are constantly trained and educated on current and upcoming cannabis taxes and regulations to help your business maintain compliance. We can help structure your cannabis company and provide you with ongoing accounting services to not only save you money, but mitigate an IRS cannabis audit.

Learn what a difference it makes to collaborate with a CannaBZ Accounting that comprehends the complexities of your industry and the difficulties you confront.

Cannabis Cultivators, Growers & Manufacturers

Running your cultivation or manufacturing facility is complicated enough without having to worry about accounting and taxes. Dark Horse Cannabis ACCOUNTING FIRMs ensure your financial house is in order so you can focus on what you do best.

Dispensary Bookkeeping & Accounting

It's high time your business has financials which help inform your business decision making. "Thanks" to 280E, dispensaries tend to operate on razor-thin margins or at a loss after taxes. Having rock-solid financials allows your business to make decisions to boost your bottom line.

Cannabis Industry Accounting

Our mission is to holistically serve your cannabis business. Not just taxes. Not just bookkeeping. Not just fractional CFO. We know your business will be best supported when these service areas come together cohesively.

Distributors

- Accounting assistance for consignment model inventory

- Tax planning and accounting services

- Assistance with inventory management

- Assistance with financial projections and forecasting

Dispensaries

- Cash management and accounting services

- Inventory tracking and management

- Point of Sale (POS) system setup and support

- Compliance with state and local regulations

CPG Manufacturers

- Cost accounting and inventory management

- Assistance with setting up a compliant payment processing system

- Tax planning and preparation services

- Assistance with navigating federal and state regulations

Cultivators

- Assistance with cost accounting and inventory management

- Tax planning and preparation services

- Assistance with selecting and setting up an accounting software

- Guidance on 280E compliance and cost segregation